Nebraska SBDC Blog

- UNO

- College of Business Administration

- Nebraska Business Development Center

- Nebraska SBDC Blog

- Additional Resources

- SBDC Blog

- Staff Directory

- NBDC News Center

Don’t Miss Out On New Covid-19 Tax Credits

Posted by NBDC Communications on Sep 08, 2020 11:52:31 AM

To help small businesses and self-employed workers stay afloat due to the COVID-19 outbreak, the IRS created new tax credits, including:

- Employee Retention Credit

- Paid Sick Leave Credit

- Paid Family and Medical Leave Credit

But carving out extra time to figure out which tax credit options you may qualify for — while adapting your business to COVID-19 — can be an overwhelming and time-consuming experience. Federal financial relief programs often have rules, provisions, and exceptions that are hard to understand at a glance.

Answer a personalized set of simple questions, and you can efficiently find out which COVID-19 related tax credits and deferrals make the most sense for your business.

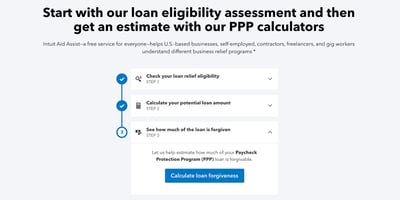

Developed with artificial intelligence, Intuit Aid Assist also estimates how much money you may get from each of the programs, with a detailed breakdown and explanation of how the amount is calculated.

- Employee Retention Credit: Claim up to $5,000 per employee for all calendar quarters if you didn’t get a PPP loan

- Paid Sick Leave Credit: Claim up to $5,110 per employee for sick leave wages paid

- Paid Family and Medical Leave Credit: Claim up to $10,000 per employee for family leave wages paid

- Social Security Tax Deferral: Defer 50% of eligible Social Security tax payments so that you pay half by December 31, 2021 and pay the remainder by December 31, 2022

What’s the difference between paid sick leave versus paid family and medical leave? What counts as qualified sick and family leave wages? What types of wages qualify for the Employee Retention Credit? Throughout the interactive guided flow experience, Intuit Aid Assist’s Tax Credit Estimator addresses these types of frequently asked questions in a way that’s easy to understand.

See what customers are saying about the Tax Credit Estimator

“When every dollar counts as much as every minute, fear of financial risk or time wasted becomes very real. The tax credit estimator does a great job of breaking down complex rules into digestible chunks. A few prompts helped me to navigate our next steps clearly and effectively.” — Ali Ramzanali, CEO of The Werd Company

“Our company was about to send payment for Social Security tax until we learned about the Social Security tax deferral. The tool helped us keep money in our pocket longer, which we could use for our cash flow this year. We are thrilled to have learned how to navigate tax relief programs through Intuit’s support for small businesses like us.” — Andrew Javellana, Director of Operations at Ability Therapy Inc.

“I spent about 20 minutes going through the Tax Credit Estimator. It’s helpful knowing that there are credits available. Our company was eligible for the Employee Retention Credit, and I decided to hire an accountant to get the best results.” — Eric Friall, Simply e-Connect

Printed with permission from ASBDC. For the original article, click here.

Posts by Tag

Contact Us

- Administrative Office

- 200 Mammel Hall

- 6708 Pine Street

- Omaha NE 68182

- 402.554.NBDC (6232)

- nbdc@unomaha.edu

- Consultant Directory